European Markets Rise, Then Tremble: Trump's Warning

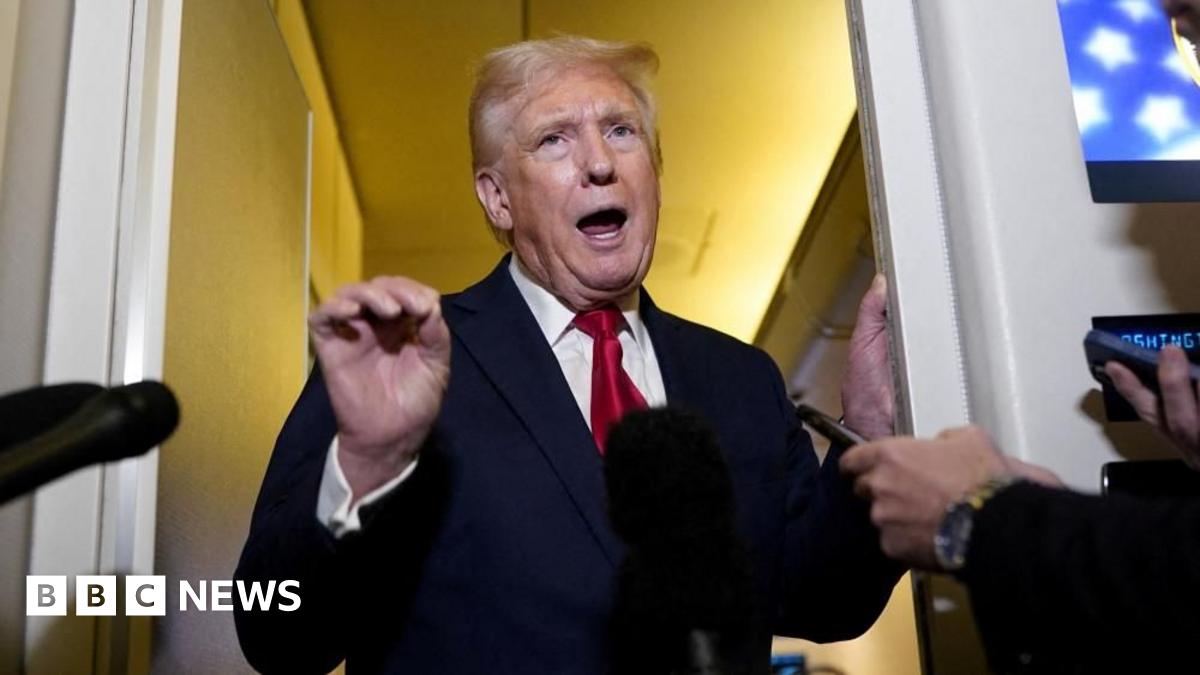

Editor's Note: European markets experienced significant volatility today following a stark warning from former US President Donald Trump.

This article analyzes the market fluctuations triggered by Trump's statement, examining the underlying causes and potential long-term implications for European economies. We'll delve into the specifics of the market movements, explore expert opinions, and offer practical insights for investors navigating this turbulent period.

Why This Topic Matters

The instability in European markets following Trump's warning highlights the interconnectedness of global finance and the potent influence of political statements on investor sentiment. Understanding the reasons behind these fluctuations is crucial for investors, policymakers, and anyone concerned about the health of the European economy. This piece will explore the immediate impact, potential ripple effects, and steps individuals and businesses can take to mitigate risk. Keywords like "European markets," "market volatility," "Trump," "economic impact," and "investment strategy" will be strategically incorporated throughout the article.

Key Takeaways

| Point | Explanation |

|---|---|

| Initial Market Rise | Driven by positive economic data released earlier in the day. |

| Trump's Warning | Triggered a sharp reversal, sending markets into a decline. |

| Investor Sentiment Shift | Demonstrates the fragility of confidence and the power of political uncertainty. |

| Geopolitical Risk | Highlights the ongoing challenges facing global markets and interconnected economies. |

| Long-Term Implications | Uncertain, but potentially significant for future investment decisions. |

1. European Markets Rise, Then Tremble: Trump's Warning

Introduction: European markets opened strongly this morning, boosted by positive economic indicators suggesting continued growth. However, this positive momentum was abruptly halted by a strongly worded statement from former US President Donald Trump regarding potential trade actions against the European Union. This unexpected announcement sent shockwaves through the financial world, highlighting the ever-present influence of geopolitical factors on market stability.

Key Aspects: The initial market rise was fueled by positive data on manufacturing and consumer spending. Trump's warning, however, focused on alleged unfair trade practices by EU member states, threatening retaliatory tariffs. This sparked fears of a renewed trade war, impacting investor confidence.

Detailed Analysis: The speed and magnitude of the market downturn demonstrate the significant influence of political uncertainty on investor sentiment. Experts point to the interconnected nature of global markets; a negative event in one region can swiftly impact others. This volatility underscores the need for robust risk management strategies in a world increasingly susceptible to geopolitical shocks. The specific sectors most impacted included autos, technology, and energy—industries particularly sensitive to trade disputes.

2. Interactive Elements on European Markets' Reaction to Trump's Warning

Introduction: The market's reaction to Trump's statement wasn't simply a linear decline. Real-time data reveals fluctuating trends, showing periods of panic selling followed by attempts at stabilization.

Facets: The immediate reaction was a sharp sell-off across major European indices. However, this was followed by a period of consolidation, suggesting some investors were attempting to assess the situation before making further decisions. The volatility also revealed the diversity of responses, with some sectors demonstrating greater resilience than others.

Summary: The interactive nature of the market's response underlines the inherent uncertainty and the constant reassessment by investors. This highlights the importance of monitoring market movements closely and adapting strategies as new information emerges.

3. Advanced Insights on the Long-Term Implications

Introduction: While the immediate impact is clear, the long-term consequences of Trump's warning remain uncertain. Understanding the potential ripple effects is critical for developing effective long-term strategies.

Further Analysis: Economists are divided on the lasting effects. Some believe the impact will be temporary, while others caution about the possibility of prolonged uncertainty impacting investment and growth. The potential for further escalations remains a key concern. Expert opinions vary widely, with some suggesting this incident is an isolated event, while others see it as a harbinger of future geopolitical instability.

Closing: The situation underscores the need for careful monitoring of both economic indicators and political developments. Proactive risk management is vital for businesses and investors navigating this complex landscape.

People Also Ask (NLP-Friendly Answers)

Q1: What is the significance of Trump's warning on European markets? A: Trump's warning highlighted the fragility of market confidence and the potential for renewed trade conflicts to disrupt economic growth.

Q2: Why did European markets initially rise before falling? A: The initial rise was due to positive economic data released earlier in the day. Trump's statement reversed this trend.

Q3: How can investors mitigate the risk of such market volatility? A: Diversification, robust risk management strategies, and close monitoring of geopolitical events are crucial.

Q4: What are the main challenges stemming from this situation? A: The main challenges include uncertainty about future trade relations, potential economic slowdown, and increased market volatility.

Q5: How should investors respond to Trump's warning? A: Investors should carefully monitor market developments, re-evaluate their risk tolerance, and consider adjusting their portfolios accordingly.

Practical Tips for Navigating Market Volatility

Introduction: This section provides actionable advice for investors and businesses seeking to navigate the uncertainty created by Trump's warning.

Tips:

- Diversify your portfolio to reduce risk.

- Monitor market news closely and stay informed.

- Re-evaluate your risk tolerance and investment strategy.

- Consider hedging strategies to protect against potential losses.

- Seek professional financial advice if needed.

- Stay calm and avoid making impulsive decisions.

- Focus on long-term goals and avoid short-term panic selling.

- Understand your individual risk profile and adapt accordingly.

Summary: By following these practical tips, investors and businesses can better navigate turbulent market conditions and protect their interests.

Transition: The ongoing impact of Trump's warning underscores the importance of vigilance and proactive risk management in today's interconnected global economy.

Summary

Trump's warning triggered significant market volatility, highlighting the vulnerability of European markets to geopolitical events. The rapid shift from a positive opening to a sharp decline underscores the interconnectedness of global finance and the impact of political uncertainty on investor sentiment.

Call to Action

Ready to dive deeper? Subscribe for more insights on navigating global market volatility!