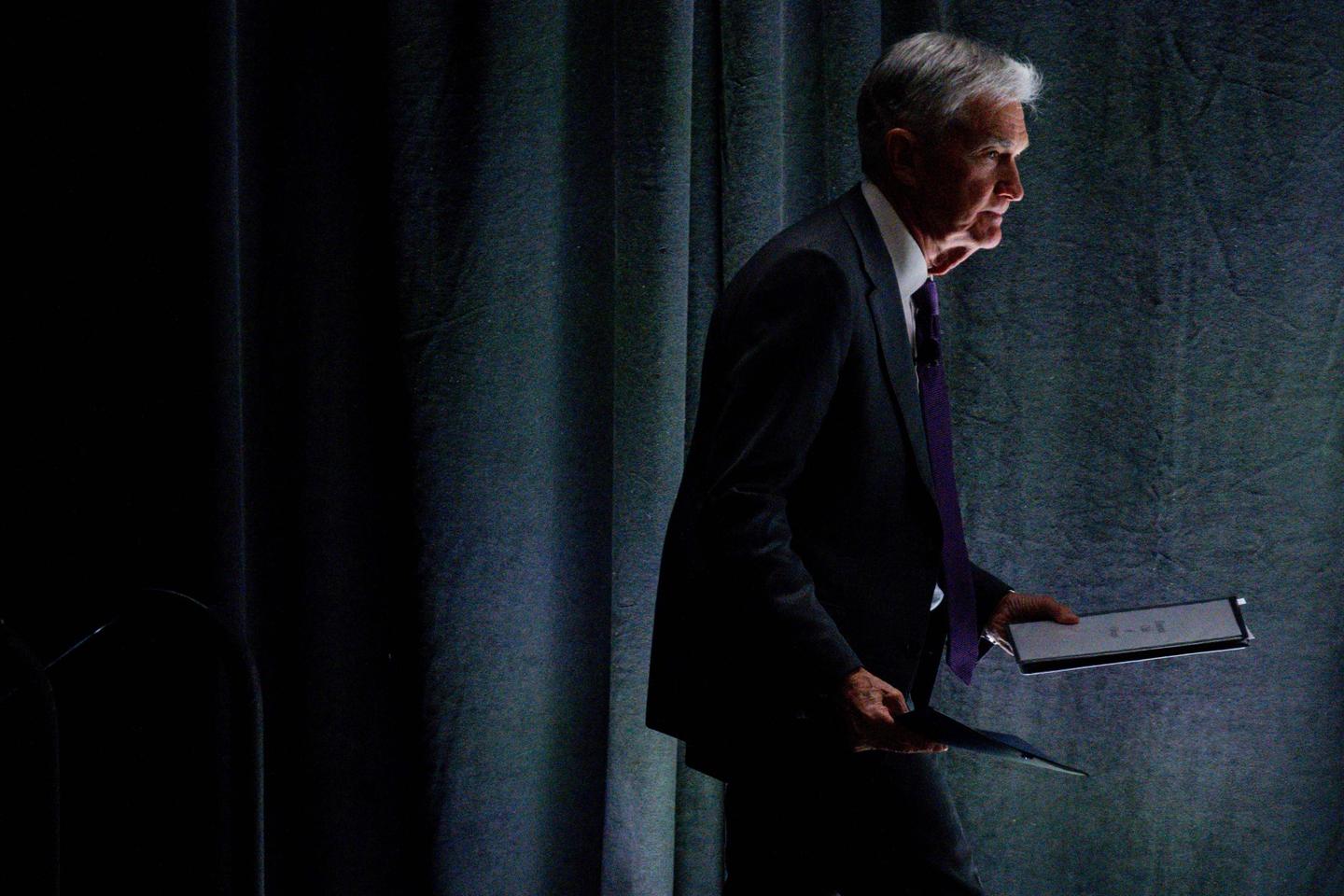

Trump Menace Powell: The Federal Reserve in Peril?

Editor’s Note: Concerns over potential political interference in the Federal Reserve are escalating following recent statements by former President Trump.

This article examines the implications of Donald Trump's renewed criticisms of Federal Reserve Chairman Jerome Powell, exploring the potential threats to the Fed's independence and the broader economic consequences. We'll delve into the history of Fed-political interactions, analyze Powell's current challenges, and assess the risks to the US and global economies.

Why This Matters: The independence of the Federal Reserve is a cornerstone of the U.S. economic system. Political interference undermines the Fed's ability to make objective decisions based on economic data, potentially leading to inflation, instability, and diminished investor confidence. Trump's outspoken criticism represents a significant threat to this independence, impacting not only the U.S. but also the global financial landscape. This situation necessitates a thorough understanding of the stakes involved.

| Key Takeaways |

|---|

| Trump's Criticism of Powell |

| Historical Precedents of Fed Interference |

| Potential Economic Consequences |

| Threats to Fed Independence |

| Global Market Reactions |

Trump Menace Powell: A Looming Crisis?

The recent resurgence of Donald Trump's attacks on Jerome Powell and the Federal Reserve reignites concerns about political interference in monetary policy. Trump's repeated accusations of Powell raising interest rates too aggressively, even going so far as to blame the Fed for his election loss, are not merely rhetoric; they represent a direct challenge to the Fed’s autonomy and the stability of the U.S. economy. This isn't just a partisan issue; it's a threat to the fundamental principles of a healthy financial system.

Key Aspects:

- The Nature of the Attacks: Trump's criticism isn't subtle. He's openly expressed his displeasure with Powell's policies, suggesting appointments and actions designed to influence the Fed's decisions.

- Historical Context: While not unprecedented, overt political pressure on the Fed is rare and carries significant risks. We'll examine instances where past administrations attempted to influence the Fed, highlighting the successes and failures of these attempts.

- Powell's Position: Understanding Powell’s mandate and his response to the pressures is crucial. We will analyze his public statements and actions in the context of the current economic climate.

Detailed Analysis: We will delve into the economic arguments for and against Powell's monetary policy decisions, analyzing data and expert opinions to offer a balanced perspective. We will also investigate the potential legal ramifications of any attempts to directly influence the Fed's operations.

Interactive Elements on Trump's Influence on the Federal Reserve

The impact of Trump's rhetoric extends beyond mere words. It creates an unpredictable environment impacting investor confidence and market volatility.

Facets:

- Market Volatility: Analyzing the impact of Trump's statements on market indices, interest rates, and the dollar's value.

- Investor Sentiment: Gauging the shifts in investor confidence and the potential for capital flight.

- Global Implications: Assessing the ripple effects on international markets and the global economy.

Summary: These interactive elements demonstrate the real-world consequences of political meddling in the Federal Reserve's operations, underscoring the need for its independence.

Advanced Insights on the Future of the Fed's Independence

The current situation raises critical questions about the future of the Federal Reserve's independence and its ability to effectively manage the U.S. economy.

Further Analysis:

- Legislative Responses: Exploring potential legislative reforms designed to protect the Fed from undue political influence.

- Long-Term Economic Impacts: Projecting potential long-term economic consequences of reduced Fed independence, including inflation, recession, and decreased economic growth.

- Expert Opinions: Including perspectives from economists and financial analysts on the potential risks and mitigation strategies.

Closing: Maintaining the Fed's independence is vital for long-term economic stability. The current challenges highlight the urgent need for robust mechanisms to safeguard this independence.

People Also Ask (NLP-Friendly Answers)

Q1: What is the Trump-Powell conflict about? A: The conflict centers around former President Trump's criticism of Federal Reserve Chairman Jerome Powell's monetary policy decisions, primarily interest rate hikes, which Trump believes were too aggressive and harmful to the economy.

Q2: Why is the Fed's independence important? A: The Fed's independence allows it to make decisions based solely on economic data and not political pressures, promoting stability and preventing potentially harmful short-sighted interventions.

Q3: How could political interference harm the economy? A: Political interference could lead to inflationary pressures, market instability, and a loss of investor confidence, ultimately hindering economic growth and potentially triggering a recession.

Q4: What are the potential consequences of Trump's actions? A: Trump's actions could undermine investor confidence, increase market volatility, and ultimately weaken the U.S. dollar's global standing.

Q5: What can be done to protect the Fed's independence? A: Potential solutions include legislative reforms strengthening the Fed's independence, improved public education about the importance of central bank autonomy, and a commitment from political leaders to respect the Fed's mandate.

Practical Tips for Navigating Economic Uncertainty

Introduction: The current climate requires proactive measures to navigate economic uncertainties.

Tips:

- Diversify your investment portfolio.

- Stay informed about economic news and trends.

- Review your financial plan and adjust as needed.

- Consider debt management strategies.

- Monitor inflation and adjust your spending accordingly.

- Understand your risk tolerance.

- Consult a financial advisor.

- Stay calm and avoid impulsive decisions.

Summary: These tips provide a framework for navigating the potential challenges ahead. By taking proactive steps, you can better position yourself to weather any economic storms.

Transition: The future remains uncertain, but by understanding the risks and implementing these strategies, you can increase your financial resilience.

Summary

Donald Trump's ongoing criticism of Jerome Powell and the Federal Reserve poses a significant threat to the institution's independence and the stability of the U.S. and global economies. Protecting the Fed's autonomy requires vigilance, proactive measures, and a commitment to safeguarding the integrity of the financial system.

Call to Action

Ready to stay informed about the evolving situation surrounding the Federal Reserve and the potential impact on your finances? Subscribe to our newsletter for regular updates and expert analysis!